Saipem awarded $425 million contract to develop Turkey's largest offshore gas field

Italian engineering group Saipem won a $425-million contract to continue the development of Turkey’s largest offshore natural gas field. The contract, awarded by Turkish Petroleum OTC covers the third phase in a project for the development of the Sakarya Field, with a focus on the construction three additional?pipelines, totaling around 153 km along with subsea structures. Saipem announced in a press release that these facilities will connect the newly discovered Goktepe Gas Reserve?to Sakarya’s phase 3 facility.

Tamoil appeals against the Italian Competition Watchdog's fine

Tamoil Italia said it rejects the decision of Italy's antitrust watchdog to fine it for alleged anticompetitive behavior in the motor fuel markets. It added that it will challenge the decision in court. The Italian antitrust regulator announced on Friday that it had fined Tamoil Italia as well as five other oil companies in the country, for their practices which restricted fair competition in motor fuel sales. The watchdog found that Tamoil, along with the other companies, had operated as a cartel from January 2020 to June 2023 in order to set the price for the biofuel component which contributes to the cost of fuel.

Italy and Algeria strengthen their cooperation through new business and security deals

An intergovernmental meeting held in Rome on Tuesday saw Italy and Algeria agree to cooperate in the fight against terrorism and migration, and companies sign deals in energy and telecommunications sectors. After a visit to Algiers in March by Antonio Tajani, the Italian Foreign Minister Giorgia Melons met with Algerian President Abdelmadjid Tebboune. Meloni’s government stated that Algeria was Rome’s top trading partner in Africa with a trade value of almost 14 billion euro ($16,4 billion), while Italian investments totalled 8.5 billion euro. "I am confident in the results of this summit.

Italy approves Italgas' 2i Rete gas deal with conditions

The Italian antitrust authority has approved conditionally the acquisition of 2i Rete Gas, Europe's largest gas distributor, by Italgas, a domestic competitor, on Tuesday. Italgas has agreed to purchase 2i Rete gas for 5.3 billion euro ($5.8 billion), a major step in consolidating the gas distribution sector in Italy. Italgas was asked by the antitrust agency to take several measures, including selling a part of its Italian gas distribution business, which would represent 600,000 clients out of a total 12.3 million customers that the combined entity of 2i Rete Gas could have served in its own country.

Italian government appeals Sardinia's law restricting green projects

The Italian government filed a complaint against a law that was passed by the regional government of Sardinia in December, which placed strict limits on the development and implementation of renewable energy projects on the island. The cabinet announced the appeal late on Tuesday, and it is the latest in a tug of war between the central government, and Sardinia, over the development of green energy. Sardinia’s opposition to green projects is similar to the backlash against wind developers in Galicia, a Spanish region.

Italy pilots self-driving cars in a car sharing program

A2A, along with its partners, announced on Wednesday that Italy had hosted a groundbreaking test of an autonomous vehicle for car-sharing as part of the utility's project in Brescia.Stellantis' electric FIAT500 city car left the charger, drove a kilometre in fully autonomous mode at a maximum of 30 km/h, and then stopped at a park area to simulate the experience of transporting a customer.Organisers said that it was the very first test of this kind in Europe.Each test will also be monitored by an onboard supervisor and a control center.

Exxon CEO: We want to extract value from Hess Guyana's assets

Two of Exxon Mobil's top executives stated on Wednesday that they wanted to "participate in" Hess Corp. selling its Guyana oil assets and extract value from its work developing the country offshore fields. In May, a three-person panel will decide whether Hess can proceed with its deal to sell to Chevron on the original terms. Exxon and CNOOC Ltd have challenged the deal, which is the second largest in recent oil megamergers. "We calculated the value of this asset." Exxon CEO Darren Woods said to Wall Street analysts that we have the right…

Enel reports 6.5% increase in core profit for the 9-mth period on renewable energy growth

Enel, Italy's largest utility, announced on Wednesday that its core profit for the nine months ended September rose by 6.5% on an annual basis, largely due to a strong production of renewable energy, which compensated more than enough for a drop in retail electricity prices in Italy. EBITDA, excluding extraordinary items, came in at 18.72 billion dollars, a figure that was higher than the consensus estimate of 17.3 billion euro compiled by. The ordinary net income for the period was 5,8 billion euros, exceeding an estimate of only 5.7 billion.

Italy's Lombardy will award two hydroelectric plant contracts by 2025

The local administration announced on Wednesday that the northern Italian region of Lombardy would award concessions to two small hydroelectric plants within its territory before the end of the next year. According to the region, the auction has attracted mostly Italian bidders. This could allow newcomers access to the capital-intensive industry. Five Italian bidders including ACEA Produzione, Ascopiave Group and the Italian subsidiary BkW Hydro, submitted bids to purchase a 4 Megawatt (MW), currently operated by A2A.

Sources say that bids for a new Italian energy hub are due on October 31.

Two sources familiar with the matter have said that bidders for a stake of a future venture combining the assets of Italian energy company Sorgenia and those of solar power company EF Solare must submit their binding offers by the end October. One of the sources stated that the buyer would acquire a 27.6% stake, currently held by Spanish fund Asterion in Sorgenia. This would allow him to become an investor in a new, unified energy company with a stake worth around 1 billion euro ($1.1 billion). F2i, the Italian infrastructure fund, controls both EF Solare (EF Solare) and Sorgenia (Sorenia).

Sonnedix expands solar capacity in Italy and looks at battery storage projects

The CEO of renewable developer Sonnedix said that the company is looking to expand its solar power in Italy through a series acquisitions. He also stated that the company was exploring opportunities for battery storage projects. The JP Morgan-backed company, which entered Italy as early as 2010, announced Thursday that it had acquired an 80 Megawatt (MW), solar plant in Sicily, from the local renewable construction firm Blunova. Blunova is a privately owned unit of Carlo Maresca Group. The deal is part of an broader partnership between Blunova and Sonnedix…

Total Rejects Force Majeure Notice From Chinese LNG Buyer

French oil major Total has rejected a force majeure notice from a buyer of liquefied natural gas (LNG) in China, a Total executive said during the company's full-year results presentation on Thursday."Some Chinese customers, at least one, are trying to use the coronavirus to say I have force majeure," said Philippe Sauquet, head of Total's gas, renewables and power segment."We have received one force majeure that we have rejected."A Chinese international trade promotion agency said last week it would…

BP CEO Dudley Planning to Step Down

BP Chief Executive Officer Bob Dudley is drawing up plans to step down next year, ending a tumultuous decade at the helm of the oil and gas company that swung from near collapse in 2010 to rapid growth today, sources close to the company said on Monday.BP's first American CEO has indicated several times in closed discussions in recent years that he would like to retire at the age of 65, taking him into 2020.His retirement plans were discussed at BP's board meeting in the United States last week, but no final date has been decided…

Total Cuts 200 Jobs in Denmark

French oil major Total SA said on Thursday it would cut 200 jobs in Denmark as part of the redevelopment of the Tyra gas fields in the North Sea.Total, which bought A.P. Moller-Maersk's oil and gas business in 2017, will shut production at the Tyra gas fields at the end of 2019 as part of a major redevelopment."Unfortunately, the changes mean that a number of valued colleagues will leave us," Patrick Gilly, managing director for Total's Danish North Sea operations said in a statement.When the field comes back on stream in 2022…

Environmental Activists Block BP London HQ

Greenpeace activists blocked the entrance to BP's London headquarters on Monday, demanding one of the world's biggest energy companies ends all new oil and gas exploration or goes out of business.Greenpeace activists arrived at the building in St James' Square in central London at 0200 GMT and encased themselves in specially designed containers to block all of the main entrances.A team of activists abseiled from the top of the building and placed huge letters over the windows reading 'CLIMATE EMERGENCY'."BP is fuelling a climate emergency that threatens millions of lives and the future of the living world…

Repsol Net Profit Up 7.5%

Spanish oil and gas firm Repsol beat forecasts with a 7.5 percent increase in fourth-quarter adjusted net profit on Thursday, boosted by higher oil and gas prices and increased production, and said its strategic plan was on track.Repsol started new projects in Algeria, Trinidad and Tobago, Britain, Peru and Malaysia during 2018, and benefited in October-December from an annual rise in prices and lower exploration costs.The company said it was on track to deliver its 2018-2020 strategic objectives, which include 15 billion euros ($17.1 billion) in spending, cutting debt and investing in renewables.In the fourth quarter

ADNOC Seals $5.8 bln Refining and Trading Deal with ENI, OMV

Italy's Eni and Austria's OMV have agreed to pay a combined $5.8 billion to take a stake in Abu Dhabi National Oil Company's (ADNOC) refining business and establish a new trading operation owned by the three partners.The transaction, which expands ADNOC's access to European markets, furthers Eni's diversification away from Africa and gives OMV a downstream oil business outside Europe. It was hailed as a "one of a kind" deal by ADNOC's Chief Executive Sultan al-Jaber."The whole oil and gas industry hasn't seen a transaction of this size and sophistication…

Petrobras to Resume Building Its Own Platforms

Brazil's Petroleo Brasileiro SA will build its own oil platforms again from 2023, regardless of who wins the presidential election next month, an executive at the state-run oil company said.Petrobras' 2019-2023 business plan, set to be released in December, should include a resumption of platform construction thanks to the company's improving finances, Petrobras' director for production and technology development Hugo Repsold said."We will build platforms independently of who is president," Repsold told Reuters on Wednesday night…

Lukoil Gets Approval for LPG Supplies to Ukraine

Russia's No.2 oil producer Lukoil has obtained approval from a Russian export control regulator on supplies of liquefied petroleum gas (LPG) such as propane and butane to Ukraine, traders said on Friday.LPG and diesel were listed as goods of dual purposes, meaning they can be used both for civil and military aims, amid Moscow's tensions with Ukraine.Only Kremlin-controlled Rosneft has the rights to export LPG to Ukraine, to the tune of around 40,000 tonnes per month. The fuel can be used in cars…

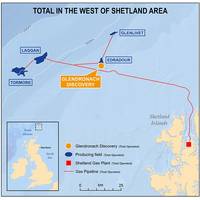

Total Makes Major Offshore UK Gas Discovery

French oil and energy group Total said on Monday it had made a major gas discovery on the Glendronach prospect, located off the coast of the Shetland islands in the North Sea.Total said preliminary tests on the new gas discovery confirmed good reservoir quality, permeability and well production deliverability, with recoverable resources estimated at about one trillion cubic feet (1 tcf).It said Glendronach, located near its Edradour field, will be tied back to the existing infrastructure and developed…