French and Benelux stocks: Factors to watch

Here are some company news and stories that could impact the markets in France and Benelux or even individual stocks. CASINO GROUPS: French retailer Casino Guichard Perrachon posted net sales of 2,00 billion euros in the third quarter. FLOW TRADERS - Flow Traders' shareholders have elected Thomas Spitz to serve as the executive director of their board and chief executive until the annual general meeting in 2029, and Caroline Terry has been approved as a non-executive member.

ExxonMobil Seeks to Sell Montana Refinery

Exxon Mobil Corp is seeking a potential buyer for its roughly 60,000 barrel per day Billings, Montana refinery, according to three sources familiar with Exxon’s plans.Representatives for large refiners, including Valero Energy Corp and Marathon Petroleum Corp, have toured the refinery, two of the people said, speaking on condition of anonymity because the process is private.Ultimately a smaller refiner could be a more likely buyer of the plant, one of the sources said.Exxon and Valero could not immediately be reached for comment.

Equinor Eyes Chevron's Stake in Rosebank Field

Norway's Equinor is interested in buying Chevron's stake in Rosebank, an oil and gas field in the British part of the North Sea, two sources close to the process told Reuters.Chevron on Wednesday said that it had received interest from a potential buyer for its 40 percent stake in one of Britain's biggest oil and gas developments.Equinor declined comment.(Reporting by Ron Bousso and Dmitry Zhdannikov; Writing by Nerijus Adomaitis; Editing by Gwladys Fouche and David Goodman)

Chevron Receives Interest in Major North Sea Field Stake

U.S. oil group Chevron has a potential buyer for its stake in one of the UK North Sea's biggest oil and gas developments, a company spokeswoman said on Wednesday.The sale of its 40 percent stake in the Rosebank project would mark Chevron's complete exit from the ageing basin after it launched the sale of its other fields in the region earlier this year.However, it was unclear if the San Ramon, California-based company was interested in selling out of the project, which…

Shell's Gabon Oil Workers Begin Strike

Royal Dutch Shell workers in Gabon began an "unlimited" strike on Thursday at all the company's operations in the Central African OPEC member country, the workers' union wrote in a letter to employees. Shell is in advanced talks to sell its Gabon assets, which one source estimated could be worth $700 million, leaving workers worried about layoffs or being moved to new locations, the union said. The national union of petroleum employees (ONEP) said the strike "will cover all of Shell Gabon's operations (Libreville, Port-Gentil, Gamba Rabi, Koula and Toucan)".

Fugro Slashes Jobs, Sheds Subsea Business Unit

Marine engineer Fugro announced a further 600 job cuts and the sale of one of its business units as it battles to cut costs in response to weak oil and gas prices. The company, which specialises in prospecting for hard-to-reach subsea deposits that are uneconomic at low oil prices, saw first-half core earnings tumble by 49 percent, though CEO Paul van Riel said he hoped conditions would improve next year. "The lack of investment is impacting on oil supply while demand is still strong," he said.

Energy Deals Elusive Despite $110 bln in Assets on the Block

Energy companies, including some of the world's biggest, could be forced to slash prices of more than $110 billion worth of assets they want to sell after dealmaking in oil and gas fields ground to a halt due to the volatile crude market. The values that buyers and sellers assign to assets, largely based on their view on the future oil price, drifted far apart in the past year, according to several industry bankers. Asking prices have been as much as 50 percent higher than what buyers are willing to pay in the era of cheap oil…

Apache Corp Rejects Takeover Advance

U.S. oil and gas company Apache Corp has rejected a takeover approach from an unidentified party and is working with Goldman Sachs on a defense, according to a report by Bloomberg on Sunday, which cited people familiar with the matter. The potential buyer sent a letter to Apache in the "past few weeks," according to one source cited in the report. It was not clear if the talks would resume, the report said. Reuters was unable to reach spokespeople for Apache on Sunday evening. Apache reported a much smaller-than-expected quarterly loss on Thursday and joined a growing list of U.S.

Samson Bankruptcy Spotlights Offshore Rig Situation

The most significant bankruptcy of the current oil downturn has shone a spotlight on what is perhaps the most oversupplied corner of the energy world: the market for offshore rig services. Samson Resources Corp, an independent oil producer bought just four years ago for $7.2 billion, said in its late Wednesday filing for creditor protection that a 60 percent crude price slide had upended its business. In the offshore space, restructurings and asset sales are widely seen as likely and some chief executive officers are now openly talking about acquisitions.

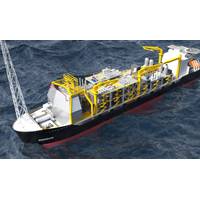

Eni Mulls Mozambique LNG Supply Deal

Italian oil and gas group Eni is holding discussions with a potential buyer of liquefied natural gas (LNG) supply from its floating export project in Mozambique, an executive said on Thursday. "We are in discussions with a potential buyer, a key term agreement has been finalised," which is forming the basis for discussions on a binding sales and purchase agreement, Umberto Vergine, Eni's Chief Midstream Gas and Power Officer said. Eni's proposed floating LNG production plant off Mozambique…

Turning Point for Coal? Japanese Buying Coal Assets

Japan is world's second-biggest coal importer; trading houses take advantage of depressed coal markets. Only a few months ago, a potential buyer said Japanese trading house Marubeni Corp was prepared to sell a costly stake in a Canadian coal mine for as little as $1. But a flurry of acquisitions of high-quality coal assets by Japanese firms in recent weeks signals that some trading houses at least are betting a depressed coal market where prices have halved in three years may be bottoming out.

Iraqi Kurdish Oil Nears US Port Despite Concern in Washington

A tanker carrying crude oil from Iraqi Kurdistan is just one day away from arriving at a U.S. port, according to ship tracking satellites, despite Washington's long-standing concern over independent oil sales from the autonomous region. The United Kalavrvta tanker, which left the Turkish port of Ceyhan in June carrying oil delivered via a new Kurdish pipeline, is due to dock in Galveston, Texas on Saturday, Reuters AIS Live ship tracking shows. A sale of Kurdish crude oil to a U.S.

Saras Places $239m Bond with Private Investors

Italian oil refiner Saras said on Wednesday it had placed a bond worth 175 million euros ($239 million) with private investors. The proceeds of the bond will be used to refinance existing debt and fund other general corporate measures, the company said in a statement. The bonds will bear a yearly coupon of 5 percent and mature on July 17 in 2019, it said. Saras, which is controlled by the Moratti family, is 21 percent owned by Russia's Rosneft. Earlier on Wednesday SocGen said in a report the share price of Saras was becoming attractive for a potential buyer…

How 'Big Corn' Lost Ethanol battle to Refiners

Six months ago the U.S. oil industry scored a surprise win against farm groups when the Obama administration proposed slashing the amount of ethanol refiners must blend into gasoline, a move that could save them billions of dollars. Stunned by the reversal, producers of the corn-based biofuel and their supporters are now fighting back ahead of a June deadline for the Environmental Protection Agency (EPA) to make a final decision on the cut. The clash has been portrayed as a battle between "Big Oil" and "Big Corn," two powerful and deep-pocketed lobbies.

GE In Talks To Buy Alstom's Power Arm

U.S. industrial conglomerate General Electric Co is in advanced talks to buy the global power division of struggling French engineering group Alstom SA for about $13 billion, sources familiar with the matter said on Friday. Sources said a deal was backed by Alstom's main shareholder, French conglomerate Bouygues with 29 percent, and could be announced in the coming days after an Alstom board meeting on Friday afternoon. The board was due to meet again on Sunday to discuss the transaction, French daily Le Figaro said.

UK Gov't Sees More Scope for Refinery Closures

Britain said on Wednesday there was scope for more UK refining capacity to close without undermining energy security but set up a new task force to help the struggling sector fend off overseas competition. The government's long-awaited review of Britain's refining and fuel imports sector comes a week after Murphy Oil said it could be forced to close its loss-making Milford Haven plant in Wales after talks with a potential buyer collapsed. In a 44-page report, the Department of Energy and Climate Change said environmental regulation along with the U.S.