Chinese Companies Shy Away From Russian Oil

Chinese state oil companies are shying away from Russian oil this month, with two importers halting purchases while two others scaled back volumes as they assess compliance following recent U.S. sanctions on Moscow, multiple trade sources said.Russian oil supplies to top buyers India and China fell sharply following the January 10 sanctions by the former Biden administration targeting Russian producers Gazprom Neft and Surgutneftegaz…

India Defends Propping Up Russian Oil - Prices "would have hit the roof"

Global oil prices "would have hit the roof" if big importer India had not bought oil from Russia following the Ukraine war, India's oil minister said, adding that prices would determine where the country buys oil from.India, the world's third largest oil importer and consumer, has become the top buyer of discounted Russian sea-borne oil shunned by Western countries since Ukraine's invasion began in early 2022. Before that…

OPEC+ Has Oil Price and Demand Problems. It Should Solve Demand

OPEC+ has two problems and two solutions.The first problem is that crude oil prices are too low for the comfort of most of the members of the group, which pulls together the Organization of the Petroleum Exporting Countries (OPEC) and its allies including Russia.The second issue is that crude demand has so far disappointed the somewhat optimistic forecasts made by OPEC for 2024 growth.The first solution is for OPEC+ to surprise…

Nigeria Seeking Operators for State-owned Oil Refineries

Nigeria's state-owned NNPC Ltd oil company said it has started the tender process for the operation of the Warri and Kaduna refineries, which are scheduled to begin processing crude this year.The oil refineries, which are being upgraded after being shut for several years, have the capacity to process 125,000 barrels per day (bpd) and 110,000 bpd, respectively.Nigeria, which is Africa's biggest oil producer, is seeking operators…

Demand Concerns Drive Oil Prices Down

Oil prices edged lower for a fifth session on Thursday as investors worried about the global demand outlook, however a decline in U.S. fuel inventories limited declines.Brent crude futures LCOc1 slipped 2 cents to $76.03 a barrel, while U.S. West Texas Intermediate crude CLc1 futures fell 13 cents to trade at $71.80 at 0840 GMT.Prices have plunged amid a report on Wednesday of revised employment statistics in the U.S., the world's biggest oil consumer…

Bangladesh Puts to use China-built Crude Oil Offloading Facility

Bangladesh started in recent days a large crude oil receiving and offloading facility built by China that allows the south Asian oil importer to significantly reduce the cost of shipping in crude oil.The single-point mooring facility at Chattogram port last Sunday offloaded 82,000 tons (about 600,000 barrels) of crude oil from a 100,000-ton tanker, said an official with state-run Bangladesh Petroleum Corp (BPC).The project is majority-funded by the Chinese government and build by a unit of Chinese state oil major CNPC, said

US Energy Firm Payouts to Oil Investors Top Exploration Spending for First Time

Top U.S. energy companies last year paid out more of their earnings to shareholders than they invested in new oil and gas fields for the first time, according to a report released on Tuesday.The outlook for stronger energy prices has not changed the focus on investor returns from the U.S. industry, according to the report's authors, Ernst & Young LLP. U.S. energy companies have been focused on regaining favor with investors…

MODEC’s FPSO Anita Garibaldi MV33 Achieves First Oil in Brazil

Japan's MODEC said its FPSO Anita Garibaldi MV33 has achieved first oil production for Petrobras at the Marlim field in the Campos Basin off the coast of Brazil.The FPSO is leased on a 25-year time charter contract to the state-owned Brazilian energy company—one of MODEC's longest charters to date.The FPSO is the 16th FPSO/FSO vessel that MODEC has delivered to the Brazilian oil and gas sector. MODEC was responsible for its engineering…

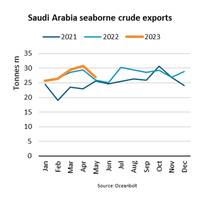

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the EIA (U.S. Energy Information Administration)…

China Banks "Massive Volume" of Crude in May

China added to crude oil stockpiles at the fastest rate in nearly three years in May, as robust imports outweighed near-record refinery processing.A total of 1.77 million barrels per day (bpd) was added to inventories in May, the most since July 2020 and reversing the small, and rare, draw of 340,000 bpd in April.When assessing the state of China's oil market, it's common to focus on the level of imports and refinery throughput…

PetroVietnam Beats Q1 Crude Output Target

Vietnam's state oil firm PetroVietnam said on Monday its crude oil output was 2.6 million tonnes in the first quarter this year, 12.6% higher than its target.The figure, however, is lower than the company's crude oil output of 2.74 million tonnes in the same period last year. PetroVietnam, formally known as Vietnam Oil and Gas Group, reported natural gas output of 1.97 billion cubic metres in the January-March period, 17.6% higher than its target.

Valero Seeks US Approval to Import Venezuelan Oil

Valero Energy Corp, the second-largest U.S. oil refiner, is seeking Washington's permission to import Venezuelan crude, according to four people close to the matter, hoping for a repeat of the approval granted to Chevron Corp in November after a four-year ban.President Joe Biden's administration has eased some U.S. sanctions on the OPEC-member nation in an effort to encourage a political dialogue with the country's opposition.

Finance: Investors Become Super-Bullish on Oil

Portfolio investors have piled into petroleum futures and options at the fastest rate since the first successful coronavirus vaccines were announced in late 2020.China’s exit from a zero-COVID strategy, along with hopes the global economy can avoid a recession and low oil inventories, have contributed to an extraordinary wave of buying across the petroleum complex.Hedge funds and other money managers purchased the equivalent…

Saudi Arabia Remains China's Top Crude Supplier

Russia remained China's second-largest source of crude oil in 2022, following repeat top supplier Saudi Arabia, as Chinese refiners snapped up low-cost Russian barrels while Western countries shunned them after the Ukraine crisis.China's crude oil imports from Russia jumped 8% in 2022 from a year earlier to 86.25 million tonnes, equivalent to 1.72 million barrels per day (bpd), data from the General Administration of Customs…

Venezuela's PDVSA Freezes Most Oil Exports for Contract Reviews

The new head of Venezuela's state oil company PDVSA has suspended most oil export contracts while his team reviews them in a move to avoid payment defaults, according to an internal document seen by Reuters and people familiar with the matter.Since U.S. trading sanctions were first imposed on PDVSA in 2019, the company has increasingly resorted to little known middlemen to allocate its oil exports, leading to big price discounts and problems with payments affecting its cashflow.The freeze order is leading to port delays…

Iranian Oil Exports End 2022 at a High, Despite No Nuclear Deal

Iranian oil exports hit new highs in the last two months of 2022 and are making a strong start to 2023 despite U.S. sanctions, according to companies that track the flows, on higher shipments to China and Venezuela.Tehran's oil exports have been limited since former U.S. President Donald Trump in 2018 exited a 2015 nuclear accord and reimposed sanctions aimed at curbing oil exports and the associated revenue to Iran's government.Exports have risen during the term of his successor President Joe Biden…

Guyana's Oil Exports Double, with Europe Taking Half of Cargoes

Guyana's oil exports jumped 164% last year, boosted by growing output and demand for the newest Latin American oil producer's light sweet crudes, particularly in Europe, where thirsty refiners ramped up imports to replace Russian supplies.Since a consortium led by Exxon Mobil began pumping in late 2019, Guyana's shipments have soared, bringing the South American nation's oil export income to $1.1 billion last year, according…

Russian Oil Revenues Falling Because of Price Cap -US Official

Russian oil revenues are falling due to the price cap that Western countries imposed on its crude oil shipments and, ahead of further caps on Russia's oil products, Europe is well positioned to manage any price pressures, a U.S. Treasury official said on Wednesday.The Group of Seven countries, Australia and the European Union will extend sanctions on Russia for its war in Ukraine by putting a price cap on its oil products, such as gasoline and diesel, on Feb.

Oil Likely to Chalk Up Weekly Loss, Recession Fears Loom

Oil prices slipped on Friday after two days of gains and are heading for weekly losses as a strong dollar and worries about a global economic slowdown weigh.Brent crude futures were down 97 cents, or 1%, at $95.62 a barrel by 0826 GMT. U.S. West Texas Intermediate crude was at $89.59 a barrel, down 91 cents or 1%. Both benchmark contracts were headed for weekly losses of close to 3%.A strong dollar has made oil more expensive for holders of other currencies…

Oil Outshines Stocks and Dollar in 2022

Oil prices are proving resilient to global economic recession fears and have outperformed major equity indices and the U.S. dollar so far this year as Western sanctions on Russia further limit supplies to an already tight market.The two major crude futures contracts are up about 30% so far this year, while the All Country World Index (ACWI) is down about 15%, Refinitiv Eikon data shows.MSCI's 47-country world stocks index…