The global investment in fusion power has increased the most since 2022

An industry group reported that global fusion energy investments grew by $2.64 Billion in the past year, since July last year, in its annual industry survey, released on Monday. However, companies surveyed said they still need more money to make the industry commercial.

Investments rose in the United States, Japan, China, and Britain, and reached their highest level since 2022.

The total funding for 53 fusion companies that participated in the survey of the Washington-based Fusion Industry Association is now $9.77 billion. This represents a fivefold increase. The investment this year was 178% higher than the $900 million raised in 2017.

Andrew Holland, FIA CEO, said that the acceleration in capital even during a tightening global economy is a sign of maturing investor trust, technological progress and a rapidly coalescing industry.

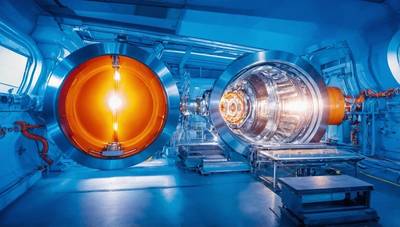

The fusion process, which powers the sun and the stars, is still in its experimental stages on Earth. However, it could generate huge amounts of energy with virtually no greenhouse gases and without producing large quantities of radioactive waste.

Scientists are working to reproduce fusion reactions using technology such as lasers and giant magnets. Commercialization is hampered by the need to lower the energy required to trigger reactions, get them to happen continuously, and develop systems for transmitting the energy.

This survey does not include public funding for fusion projects in China, where it is believed that the country is the global leader.

Some of the investors were the venture arms of traditional fossil fuel companies Chevron and Shell, Siemens Energy and Nucor - the largest U.S. Steel producer.

The increase in investment has been boosted by the surge in demand for power from data centers and artificial intelligence. Google announced last month that it had signed a contract to purchase power from Commonwealth Fusion Systems in Virginia, which aims to generate electricity by early 2030s.

Despite the increase in funding, 83% of respondents still find it difficult to get investments. Fusion companies estimated that they would require an additional $3 million up to $12.5 billion for their first pilot plant to come online. The median response was $700 million. The $77 billion total that respondents estimated they would require is eight times greater than the amount invested by investors. The survey suggested that expected industry consolidation may reduce the amount of investment required. Reporting by Timothy Gardner, Editing by Lincoln Feast.

(source: Reuters)