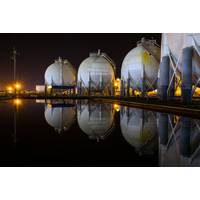

Shell's scenarios predict significant LNG growth within the next few years

Shell published scenarios on Wednesday that showed a rapid rise in global demand for liquefied gas. Gas will probably have a gradual increase, and oil could peak at the start of the next decade. The British energy company created three scenarios to model energy security on a long-term basis, but said that these do not reflect their strategy or business plans.

Shell's scenarios predict significant LNG growth within the next few years

Shell published scenarios on Wednesday that showed a rapid rise in global demand for liquefied gas. Gas will probably have a gradual increase, and oil could peak at the start of the next decade. The British energy company created three scenarios to model energy security on a long-term basis, but said that these do not reflect their strategy or business plans.

Sinopec, a top refiner, claims that China's oil demand will peak in 2027.

Sinopec, the state-owned refinery, said that China's oil demand will peak in 2027. This is due to a decline in diesel and gasoline consumption, which has slowed down global oil markets. Sinopec stated that the peak oil demand in 2027 will not exceed 800 million metric tonnes, or 16 millions barrels of crude oil per day.

Sinopec predicts China's oil consumption will peak in 2027

Sinopec (China Petrochemical Corp.) expects China’s petroleum consumption will peak in 2027, at no more that 800 million metric tonnes or 16 million barrels a day. The state energy group released an outlook on Thursday. The forecast is more precise than the one made by the giant refining company last year when it estimated…

Vitol: China remains the main driver of global oil demand despite energy transformation

The global head of Vitol’s research department said that China will continue to play a major role in the global oil market because it is focused on petrochemicals, even though fuel consumption for road transport in China peaks during energy transition. The No. The world's No. There is no doubt about it, this will be the driving force for oil demand in China as well as globally.

Rystad: Oil Demand to Peak in 2026

The rapid adoption of electric vehicles (EV) around the world will probably cause global oil demand to peak two years earlier than previously expected, Norway's biggest independent energy consultancy Rystad said on Wednesday.World demand is now seen peaking at 101.6 million barrels of oil per day (bpd) in 2026, down from a forecast made in November of a peak in 2028 at 102.2 million bpd…

Large Oil Firms Invest in Shale

Oil majors are readying themselves for the energy transition by investing in shale and waiting for renewable technology to be economical, said Rystad Energy, energy research and business intelligence company.A recent review of 2019 capital budgets reveals that oil majors are the only group to increase shale expenditure…

Vitol Sees Gas and LNG as Key Growth Driver

Vitol's future growth will increasingly be driven by gas and liquefied natural gas (LNG), especially in emerging markets, as peak oil demand approaches, its head of gas and power investments said on Thursday.Steven Brann said that LNG and gas, coupled with related asset acquisitions, will offer the best growth opportunities for Vitol as the world moves towards cleaner-burning fuels and oil demand

Peak Oil Demand and its Implications for Prices: Kemp

Even if oil consumption reaches a peak and then starts to fall, the world will still need large quantities of oil for many decades to come. The prediction is contained in a thoughtful paper co-authored by Spencer Dale, chief economist of BP, and Bassam Fattouh, director of the Oxford Institute for Energy Studies. "Global oil demand is likely to continue growing for a period…

OPEC Should Heed Achnacarry Lessons: Kemp

OPEC members are struggling to protect their revenues in the face of renewed competition from U.S. shale producers and other suppliers outside the organisation. OPEC's revenues from petroleum exports have fallen to just $446 billion in 2016 from $1.2 trillion in 2012 ("Annual Statistical Bulletin", OPEC, 2017). But past…

Oil Rises Above $50 on OPEC Cut Comments

Oil edged above $50 a barrel on Thursday, drawing support from sources' comments that OPEC's Gulf members are willing to cut their output by 4 percent and from a further drop in U.S. crude inventories. Saudi Arabia and its Gulf OPEC allies are willing to make that reduction from their peak oil output, energy ministers from the Gulf countries told their Russian counterpart this week…

As Cracks Emerge in Global Oil Pact, Saudis May Need to Compromise

Tough negotiations await a group of OPEC experts as they meet their counterparts from other oil producers such as Russia on Oct. 28-29 to hammer out details of an output-capping agreement, with disagreements threatening to scupper the deal. OPEC agreed in Algeria last month on a modest oil-production cut in the first such pact since 2008…

Doha Meeting Might Not Matter Much for Oil Prices

Given the hype which has accompanied the run-up to an oil ministers' meeting in Doha on Sunday, there is a risk prices will fall afterwards it fails to reach an agreement or produces only a weak one. But expectations for the meeting are already pretty low. "We cannot know the outcome but if there is to be a production freeze…

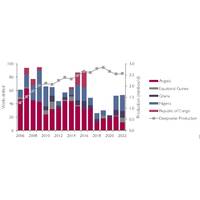

West Africa: The Deepwater Bubble Bursts

A year ago, Douglas-Westwood (DW) commented that E&P companies within West Africa were focusing reduced Capex plans on high-quality deepwater assets in the region. At the time, Brent crude was rebounding towards a mid-2015 peak of over $60 per barrel. However, in the months since this peak, oil prices plummeted once more, with Brent reaching lows of $26 per barrel in January 2016.

Mexico's Oil Auction beats Expectations Despite Price Plunge

Mexico's oil regulator awarded all 25 contracts on offer on Tuesday, beating expectations despite a dramatic plunge in crude prices, in an auction aimed at boosting new Mexican oil companies after a historic sector reform finalized last year. Peak oil production from the 25 onshore fields will reach 77,000 barrels per day and attract investment of $1.1 billion…

Flow of Iraqi Oil to U.S. Reaches 3-year Peak

Oil tankers are set to deliver the biggest volume of Iraqi crude to U.S. shores in more than three years, as OPEC's second-largest producer vies for market share as pressure mounts on U.S. shale production. According to Reuters shipping data, tankers carrying nearly 20 million barrels of Iraqi oil are due to sail to the United States in November…

"Peak Demand" Could Spell End of $100 Oil

As oil supplies are abundant, demand could hit apex; shift to cleaner energy to hit oil consumption. Just as the energy industry has brushed aside concerns that the world could run out of oil, industry executives now say they believe it is demand, rather than supply, that is nearing its apex. In 1985, Ian Taylor, today the chief executive of the world's largest oil trader Vitol…

Kemp: U.S. Crude Oil Stocks Return to 1930s Crisis Levels

U.S. commercial crude oil stocks last week hit their highest level since 1931 - when the opening of giant oil fields in the United States coincided with the Great Depression to create an enormous glut and sent prices tumbling to just 13 cents per barrel. Commercial crude stocks at refineries and tank farms across the country rose to almost 407 million barrels on Jan 23…

Bakken Oil Wells and the Red Queen's Revenge

More than 22,000 wells have been drilled in North Dakota since oil was discovered in 1951, but over half of state production comes from around 4,000 wells drilled since the start of 2013. By the end of Oct 2014, there were nearly 11,900 wells producing oil and gas in the state. The rest proved dry, or had been shut in or plugged and abandoned as output has dwindled.

The Last of a Dying Breed

Denmark is the European Union’s (EU) only net exporter of oil. The Nordic state’s oil exports totalled approximately 13.7 million barrels of oil equivalent in 2013. This is in stark contrast to the EU’s only other significant oil producer, the UK, which became a net importer in 2004 and has experienced a steep decline in output since…