Darwin LNG begins shipments on the Kool Blizzard with its first cargo

Ship-tracking data revealed that the Darwin liquefied gas plant (DLNG), operated by Australian oil producer?Santos since restarting operations, had exported its first shipment. The shipment is currently heading to Sakai in Japan. Darwin LNG stopped shipments at the end of 2023, as its previous gas supply, the Bayu Undan Field in the Timor Sea was running out. The Barossa project, owned by Santos and SK E&S and JERA, is now supplying the plant with natural gas.

Lachlan Harris, an insider at Santos Australia, is named finance director

Santos announced on Friday that it had appointed Lachlan Harri as its new 'CFO'. The Australian gas producer is currently navigating a period of transition tied to the Barossa, and Pikka project. Sherry Duhe, the former CFO who left the position in October after just a year, was replaced by the new CFO. Analysts pointed out at the time that Duhe's departure left Santos without a clear succession, since she was widely seen as a potential successor to CEO Kevin Gallagher if he chose to step down.

Santos ex-finance chief blames 'untenable' leadership environment for exit

Sherry Duhe, former chief financial officer of Santos Australia, says that she quit the company after only a year because it was "untenable" in terms of leadership and due to her disagreements with Kevin Gallagher. Santos announced Duhe’s departure on 14 October, less than one month after a bid of $18,7 billion for the company by Abu Dhabi National Oil Company failed. In response to a question about the reasons behind her departure…

Santos reduces 2025 production forecast on technical issue at Barossa Project

Santos Australia has lowered its output forecasts for the second time in this year after a technical problem delayed ramp-up at its Barossa project. Inclement weather also hampered recovery of the Cooper Basin project. No. 2 independent oil and gas producer in the country now expects to produce 89-91 million barrels of oil equivalent (mmboe) during fiscal 2025, compared with 90-95 mmboe previously forecast. The country's no.

Sherry Duhe, Santos' Finance Chief, resigns after one year in the role

Santos announced on Tuesday the resignation of CFO Sherry duhe, only one year after she assumed the position. The Australian gas producer is navigating a period of transition ahead of the start-up of its Barossa, and Pikka, projects. Duhe was appointed as Santos' new CEO in September of last year, amid speculation about a possible leadership change. Lachlan Harris, the current Deputy CFO of the company, has been appointed acting Finance Chief.

Australia's Santos Chief executive bets on cash-flow boost as third bidder walks away

Kevin Gallagher, Santos' boss, said on Friday that he does not plan to retire. He expects the company to see a dramatic increase in cash flow over the next few decades. This comes after the third takeover bidder in seven years backed out of a deal. A consortium led by Abu Dhabi National Oil Company, or ADNOC, failed to make a $18.7-billion bid for Santos due to disagreements over commercial terms. This led analysts and investors alike…

Santos, Australia's gas supplier, signs a deal with Orica to supply Narrabri to Orica

Santos, Australia's second largest gas producer, announced on Thursday that it had signed an agreement to discuss a possible domestic gas supply contract from its Narrabri Gas Project located in New South Wales. Santos will supply Orica with up to 15 petajoules per year and for ten years. Kevin Gallagher, Santos managing director and chief executive officer, said that the memorandum of agreement highlights Santos’s interest in domestic supply from Narrabri.

Santos adjusts its 2025 production forecast in response to the Cooper Basin Floods

Santos, Australia's largest oil and gas company, tightened its production forecast for the full year on Thursday in order to take into account flood-related disruptions. It also reported a decline of more than 2% in its second-quarter revenue. In 2025, the country's second largest gas producer is expected to produce 90 million to 95 million barrels equivalent oil (mmboe), compared with an earlier forecast of 90-97 million mmboe.

Australia's Santos signs LNG deal with QatarEnergy unit

Santos, an Australian oil and natural gas producer, announced on Friday that it had signed a long-term contract for the supply of liquefied gas with QatarEnergy Trading. This is a unit owned by QatarEnergy which is the largest LNG exporter in the world. Santos has agreed to supply 0.5million tonnes of LNG annually over a two-year period starting in 2026. In a statement, the company said that it would supply the commodity from its wide portfolio of LNG assets.

Analysts say that 'deep pockets' may help Abu Dhabi gain regulatory approval for Santos' bid.

Analysts say that the Australian regulators who are concerned about gas supplies in Australia will be closely monitoring Abu Dhabi National Oil Company's bid of $18,7 billion for Santos. However, they could be won over by promises to accelerate new projects. Analysts say that Santos' shares closed Tuesday at A$7.73, a far cry from the $5.76 per share (A$8.89), which was the proposed takeover bid for Australia's 2nd largest gas producer, announced on Monday.

CERAWEEK - Australia's Santos will increase investment in the US due to pro energy policy - CEO

Kevin Gallagher, CEO of Santos Australia, said that the company will increase its investments in the United States due to the energy-friendly policies of President Donald Trump and his administration. Trump wants to maximize the domestic oil and natural gas production, and has reverted many of Joe Biden's policies that were meant to encourage a shift to a low-carbon economy. Gallagher, in remarks made at the CERAWeek Conference in Houston, said: "We will increase our investment in the U.S.

Santos Australia targets higher output in 2025, pinning hopes on Barossa Project

Santos, Australia's largest oil and gas company, forecast higher production for fiscal 2025 based on the expectation that Barossa will start production this year. The company also reported a sequential increase in its fourth quarter revenue on Thursday. Santos is the second largest independent gas producer in the country. Santos, the country's no. Visible Alpha's consensus was 89.9 million mmboe. If gains continue, shares could rise as high as 1.7% at A$7.250.

Australia's Santos signs LNG deal with TotalEnergies

Santos, an Australian gas supplier, announced on Wednesday it had signed a contract for a midterm supply of liquefied gas with TotalEnergies Singapore. Santos said that under the contract which lasts a little more than three years it will provide 20 LNG cargoes or about 500,000 tons of LNG each year. The contract is expected to begin in the fourth quarter 2025. Santos will provide the LNG delivered ex-ship basis (DES) to TotalEnergies Gas & Power Asia.

Santos' new CFO shines spotlight on succession in top jobs

The Australian energy giant Santos announced on Thursday that Sherry Duhe, a former Woodside and Newcrest executive, has been appointed as its chief financial officer. This announcement comes amid heightened market speculation regarding a possible change in the top position. Duhe will replace Anthea McKinnell as chief financial officers. McKinnell leaves Santos after more than half a century. Kevin Gallagher, CEO of Santos in 2021…

Santos LNG from Australia to Glencore Singapore

Santos, an Australian company, announced on Wednesday that it had signed a contract for a midterm supply of liquefied gas with Glencore Singapore. Glencore Singapore is a subsidiary of the London-listed Glencore. Santos has agreed to supply 19 LNG cargoes or approximately 0.5million tonnes of LNG annually over the course of three years plus a quarter. The contract will begin in the fourth fiscal quarter of 2025, with LNG coming from the company's global portfolio.

Woodside Energy's earnings to drop as investors focus on strategic deals

Woodside Energy is Australia's largest independent gas producer and on course to report a decline in its interim earnings on February 2, with investors focused on the company's deal-making strategies after a failed $52 billion merger between Santos. According to Jarden's Visible Alpha consensus, Woodside, based in Perth, is expected to report a underlying net loss after tax of $1.11billion for the six-month period ended June. This compares to $1.90billion reported a year earlier.

Santos Posts Record High Output

Australia's number two independent gas producer Santos Ltd on Thursday said third-quarter production and sales volumes peaked to record levels, benefiting from higher output from its Western Australia assets.Revenue of $1.03 billion was the second highest quarterly sales on record, the company said in a statement, while production surged 32% to 19.8 million barrels of oil equivalent (mmboe), beating an estimate…

Santos Acquires ConocoPhillips’ Northern Australia Interests

Santos announced it has acquired ConocoPhillips’ northern Australia business with operating interests in Darwin LNG, Bayu-Undan, Barossa and Poseidon for US$1.39 billion plus a $75 million contingent payment subject to FID on Barossa.Matt Fox, ConocoPhillips executive vice president and chief operating officer, said, “While we believe the Darwin LNG backfill project remains among the lower cost of supply options for new global LNG supply…

Santos Posts Record Production in Q1

Australia's No.2 independent gas producer Santos Ltd on Wednesday posted record quarterly production, boosted by its acquisition of Quadrant Energy assets, while sales revenue jumped 28 percent.Santos said production for the quarter ended March 31 rose to a record 18.4 million barrels of oil equivalent (mmboe), up from 13.8 mmboe last year.Revenue came in at $1.02 billion, the second-highest quarterly revenue on record…

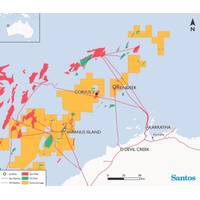

Santos Finds Gas Off Western Australia

Santos announced Tuesday it has confirmed significant gas resource in the Corvus-2 appraisal in the Carnarvon Basin, offshore Western Australia.Corvus-2 is located in 63 meters water depth, approximately 90 kilometers northwest of Dampier in Commonwealth waters within petroleum permit WA-45-R, in which Santos has a 100% interest.The well was drilled approximately 3 kilometers southwest of Corvus-1 (drilled in…