Douglas-Westwood: Nowhere Fast

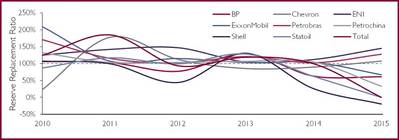

E&P deepwater exploration and appraisal activity has dramatically declined. In line with falling E&A activity, Reserve Replacement Ratios (RRRs) have been declining for the majority of major E&P companies. Douglas-Westwood highlights some of the positive newsflow from offshore E&A activity in recent times.

Myanmar, once impeded by political and economic trade embargoes, has seen a dramatic turnaround in fortunes since the lifting of international sanctions in 2012. A number of Western E&P players such as Shell, ENI and Chevron, as well as Independents including Reliance Industries and Oil India amongst others, have been drawn to the country’s gas potential, most notably in the deepwater Rakhine basin. Following the discovery of the Thalin-1 well in the AD7 block in Feb 2016, Woodside has shown significant commitment to exploring and developing acreage (up to 4-7 E&A drilling campaigns). The Australian operator has recently contracted the Dhirubhai Deepwater KG2 (a deepwater drillship), scheduled for a year-long campaign in 2017.

In June 2016, an Exxon-Hess alliance has upgraded the total reserves for its Liza field discovery offshore Guyana to 1.4 billion barrels; twice the size of previous estimates. The find represents the first commercial discovery in the country for the past 50 years. The success of the Liza field has injected strong enthusiasm for exploration activities offshore neighboring Suriname, where Petronas has begun an exploration drilling campaign in May 2016, while Apache has commenced seismic acquisition on block 58 in June 2016. Compared to the tepid reaction in 2015, the current round of acreage offered by Staatsolie, a state-owned oil company, has garnered widespread interest amongst the international E&P community.

Current oil prices do not support major stand-alone deepwater developments. All of the sanctioned deepwater projects in 2016 are subsea tie-backs to shore. However, it is evident that as the market recovers there are substantial reserves that can be brought into development as oil prices allow. We expect operators to develop these finds through conceptual / front-end engineering during the downturn if they wish to be a ‘first mover’ when the market conditions allow sanctioning.